1. Introduction: Making Informed Insurance Decisions

When purchasing insurance, it’s essential to carefully evaluate several factors to ensure that you select a policy that meets your needs and fits within your budget. Insurance is a long-term financial commitment, and choosing the right plan can have a significant impact on your financial security. Whether you are shopping for life insurance, health insurance, auto insurance, or any other type, understanding what factors influence your decision will help you make an informed choice. This article highlights the key elements to consider before purchasing insurance to guide you through the process.

2. Understand Your Coverage Needs

The first and most important step when purchasing insurance is to assess your personal or family’s needs. Everyone has different financial responsibilities, life situations, and risks. What works for one person might not be suitable for another.

- Life Stage: Are you single, married, or have dependents? If you have children or a spouse, life insurance may be a top priority to secure their financial future in case of your death. On the other hand, single individuals may focus more on health or renters insurance.

- Assets: If you own a home or a car, you’ll need homeowners or auto insurance. If you rent, renters insurance provides affordable coverage for your belongings.

- Health Status: If you have pre-existing health conditions, you’ll need to look for a health insurance plan that offers sufficient coverage for treatments related to those conditions.

- Income and Financial Goals: Understanding how much coverage you need involves evaluating your current income, debts, and financial goals. Higher-income earners or those with significant assets may need higher coverage limits to protect their wealth.

Tailoring your insurance to your specific needs is crucial to ensure adequate protection and avoid unnecessary expenses.

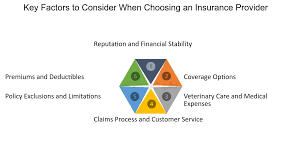

3. Premiums: What Can You Afford?

Premiums are the amount you pay for insurance coverage, typically on a monthly, quarterly, or annual basis. Understanding how much you can afford to pay for premiums is a critical factor in purchasing insurance.

- Budgeting: Determine how much of your monthly or yearly budget can be allocated toward insurance premiums. Be careful not to overextend yourself by opting for premiums that you can’t afford long term.

- Premium vs. Coverage: While lower premiums might seem attractive, it’s essential to consider whether the coverage offered is adequate for your needs. Inadequate coverage could lead to significant out-of-pocket expenses in the event of a claim.

- Balancing Premiums and Deductibles: Many insurance policies allow you to adjust the deductible (the amount you pay out-of-pocket before the policy covers the rest). Higher deductibles typically result in lower premiums, but it’s important to make sure that you can afford the deductible if you need to file a claim.

Carefully evaluate your ability to pay for the premiums while ensuring the coverage provides sufficient protection.

4. Policy Exclusions and Limitations

Each insurance policy comes with a list of exclusions—situations or conditions that are not covered under the policy. These exclusions can vary widely between insurance types and providers, and it’s crucial to be aware of them.

- Reading the Fine Print: Always read the policy documents carefully and understand what is excluded. For example, many homeowners insurance policies exclude coverage for floods or earthquakes, which might require additional insurance riders.

- Pre-existing Conditions: Health insurance policies often exclude coverage for pre-existing conditions, or they may impose waiting periods. It’s important to ask your provider about these exclusions if you have existing health issues.

- Intentional Acts: Insurance generally does not cover damage or injuries caused by intentional acts or criminal activity. Ensure that you understand what is considered “uncovered” to avoid surprises when filing a claim.

Make sure that the policy offers comprehensive coverage for the situations most likely to affect you, and be aware of any exclusions that could leave you vulnerable.

5. Policy Type: Choose the Best Fit for Your Needs

There are various types of insurance policies, and understanding the differences between them is crucial. Selecting the right type of policy that aligns with your goals and risk profile is one of the most important decisions.

- Term Life Insurance vs. Permanent Life Insurance: Term life insurance covers you for a specified period (e.g., 10, 20, or 30 years), while permanent life insurance provides lifelong coverage with a cash value component. Term life insurance is typically more affordable, but permanent life insurance can be more suitable for long-term financial planning.

- HMO vs. PPO Health Insurance Plans: Health insurance plans come in many varieties, such as Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). An HMO requires you to choose a primary care physician and get referrals to specialists, while a PPO offers more flexibility in choosing providers. Consider the level of flexibility you need and the cost difference when selecting a plan.

- Comprehensive vs. Liability Auto Insurance: If you own a car, you may have the option of purchasing liability insurance, which covers only damages to others, or comprehensive insurance, which covers damages to both your car and others’ property. Consider your vehicle’s value, the risks you face, and your budget when deciding which type is best for you.

Choose an insurance policy type that meets your needs, lifestyle, and budget.

6. Compare Different Insurance Providers

Different insurance providers offer varying levels of service, coverage options, and premiums. It’s important to shop around and compare providers before making your decision.

- Reputation and Financial Strength: Look for providers with strong financial stability. Ratings from organizations like A.M. Best or Standard & Poor’s can help you assess the financial strength of an insurer. You want to ensure that your insurer will be able to cover claims when needed.

- Customer Service and Claims Handling: Customer service and the ease of filing claims are essential factors to consider. Check reviews and ratings for insights into how well an insurer handles claims and customer inquiries.

- Policy Options and Customization: Consider whether the insurance provider offers customizable policies or additional coverage options (riders) to meet your specific needs. A flexible insurer is more likely to provide a policy that can adapt to your changing circumstances.

By comparing different insurance companies, you increase the likelihood of finding one that offers the best combination of coverage, price, and service.

7. Discounts and Savings Opportunities

Many insurance providers offer various discounts to help reduce premiums. These discounts can vary by insurer, so it’s important to ask about available savings opportunities.

- Bundling Policies: Many insurers offer discounts if you bundle multiple policies with them. For example, you may receive a discount if you purchase both auto and homeowners insurance from the same company.

- Good Driver or Claims-Free Discounts: If you maintain a clean driving record or haven’t filed any claims recently, you may be eligible for a discount on auto or home insurance.

- Wellness Programs: Some health insurance plans offer discounts for participating in wellness programs or health screenings. Similarly, life insurance policies may offer lower rates for individuals who maintain healthy habits.

Don’t forget to ask about discounts that could lower your premiums, making insurance more affordable.

8. Understand the Claims Process

Before purchasing an insurance policy, it’s important to understand how the claims process works. In the event of an accident, illness, or loss, you want to know how to file a claim and what to expect.

- Claims Filing Process: Make sure the claims process is straightforward and easy to understand. Some insurers offer online or mobile claims filing, while others may require you to contact them by phone.

- Payout Timeliness: Check how long it typically takes for the insurer to process and pay out claims. Some insurers are quicker and more reliable than others.

- Customer Support: Good customer support can make a significant difference when filing a claim. Ensure that your insurer provides accessible support in case of emergencies.

Knowing the claims process in advance will give you confidence in your insurer’s ability to provide timely assistance when you need it most.

9. Evaluate the Financial Stability of the Insurer

One of the most important factors to consider when purchasing insurance is the financial stability of the insurer. If an insurer is not financially sound, it may struggle to pay out claims, leaving you unprotected when you need it most.

- Ratings Agencies: Independent agencies like A.M. Best, Moody’s, and Standard & Poor’s evaluate the financial stability of insurers. These ratings can give you an indication of the insurer’s ability to meet its financial obligations.

- Claim Payout History: Research how well the insurer has handled claims in the past. Consistent and timely payouts indicate that the insurer is financially strong and reliable.

- Reserves and Solvency: Insurers are required to hold reserves to cover potential claims. Check whether the insurer maintains healthy reserves to handle large payouts, especially in high-risk situations.

10. Policy Flexibility and Adjustments

Your life circumstances may change over time, so it’s essential to ensure that your insurance policy can adapt to those changes. Look for policies that offer flexibility and options to adjust coverage as needed.

- Life Insurance Riders: You may want to add riders to your life insurance policy to cover additional situations, such as critical illness or disability. Choose a provider that allows you to add these options easily.

- Health Insurance Plan Changes: As your healthcare needs change, you may need to adjust your health insurance plan. Ensure that your insurer offers options to switch plans or make changes to your coverage.

- Auto and Home Insurance Adjustments: As you acquire assets or make significant changes, your auto or homeowners insurance may need to be adjusted. Choose an insurer that allows you to update your policy without hassle.

11. Conclusion: Making a Thoughtful Decision

Purchasing insurance is a critical decision that requires thoughtful consideration. By evaluating your coverage needs, premium affordability, policy exclusions, and the financial strength of the insurer, you can make an informed decision that provides adequate protection for your future. Taking the time to research your options and comparing different policies ensures that you are getting the best value for your money and the coverage you need.

With the right insurance in place, you can have peace of mind knowing that you are financially protected in case of an emergency, accident, or unforeseen event.